Renters Insurance in and around Woodland Hills

Your renters insurance search is over, Woodland Hills

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

There’s No Place Like Home

Your rented apartment is home. Since that is where you rest and relax, it can be beneficial to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your clothing, craft supplies, stereo, etc., choosing the right coverage can make sure your stuff has protection.

Your renters insurance search is over, Woodland Hills

Coverage for what's yours, in your rented home

Why Renters In Woodland Hills Choose State Farm

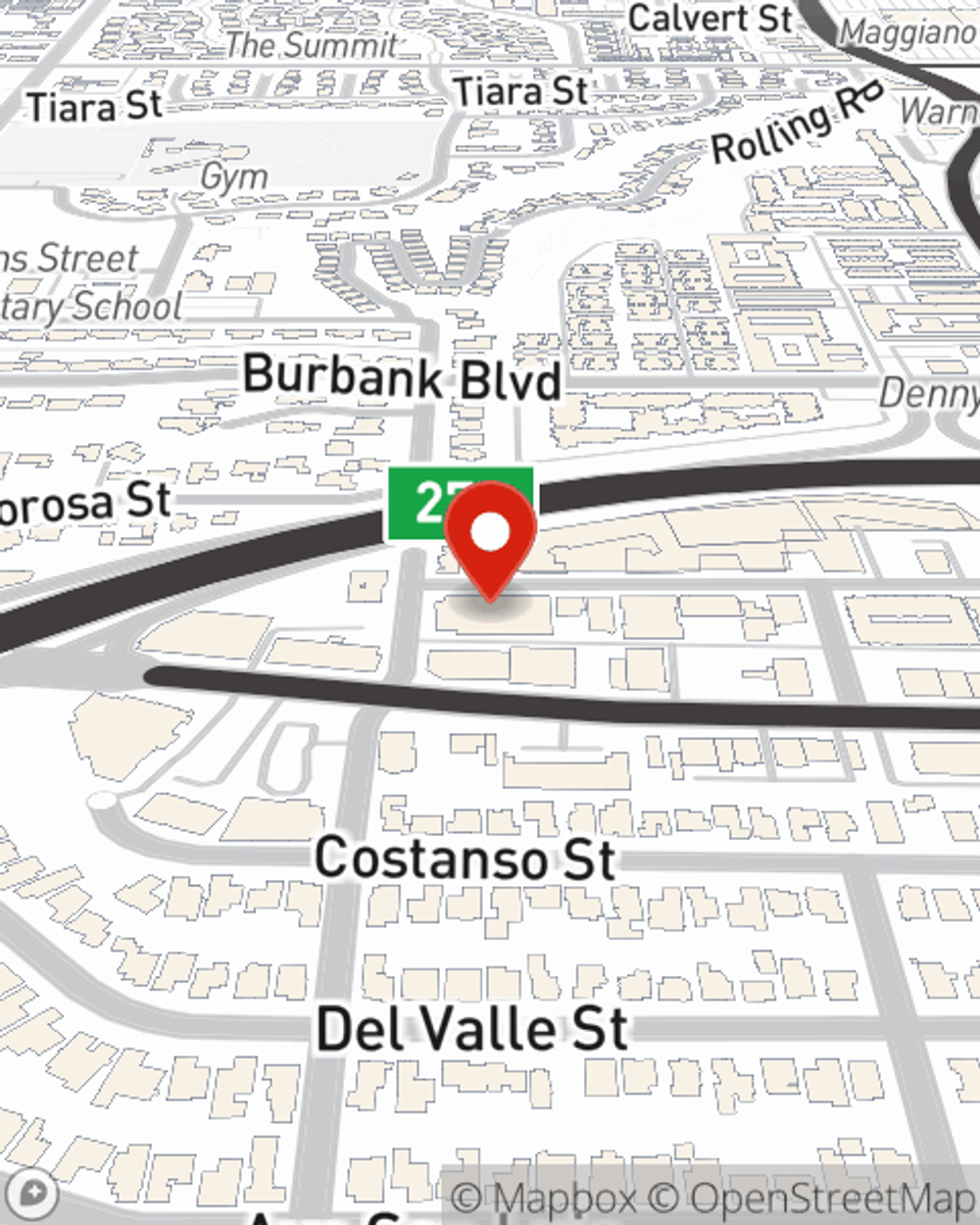

It's likely that your landlord's insurance only covers the structure of the apartment or property you're renting. So, if you want to protect your valuables - such as a cooking set, a bed or a desk - renters insurance is what you're looking for. State Farm agent Richard Lonie is dedicated to helping you choose the right policy and insure your precious valuables.

Renters of Woodland Hills, contact Richard Lonie's office to discover your personalized options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Richard at (818) 610-3100 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Richard Lonie

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.