Business Insurance in and around Woodland Hills

One of Woodland Hills’s top choices for small business insurance.

Helping insure small businesses since 1935

Help Prepare Your Business For The Unexpected.

Whether you own a an art gallery, a flower shop, or a tailoring service, State Farm has small business insurance that can help. That way, amid all the various options and decisions, you can focus on what matters most.

One of Woodland Hills’s top choices for small business insurance.

Helping insure small businesses since 1935

Protect Your Business With State Farm

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, builders risk insurance or commercial liability umbrella policies.

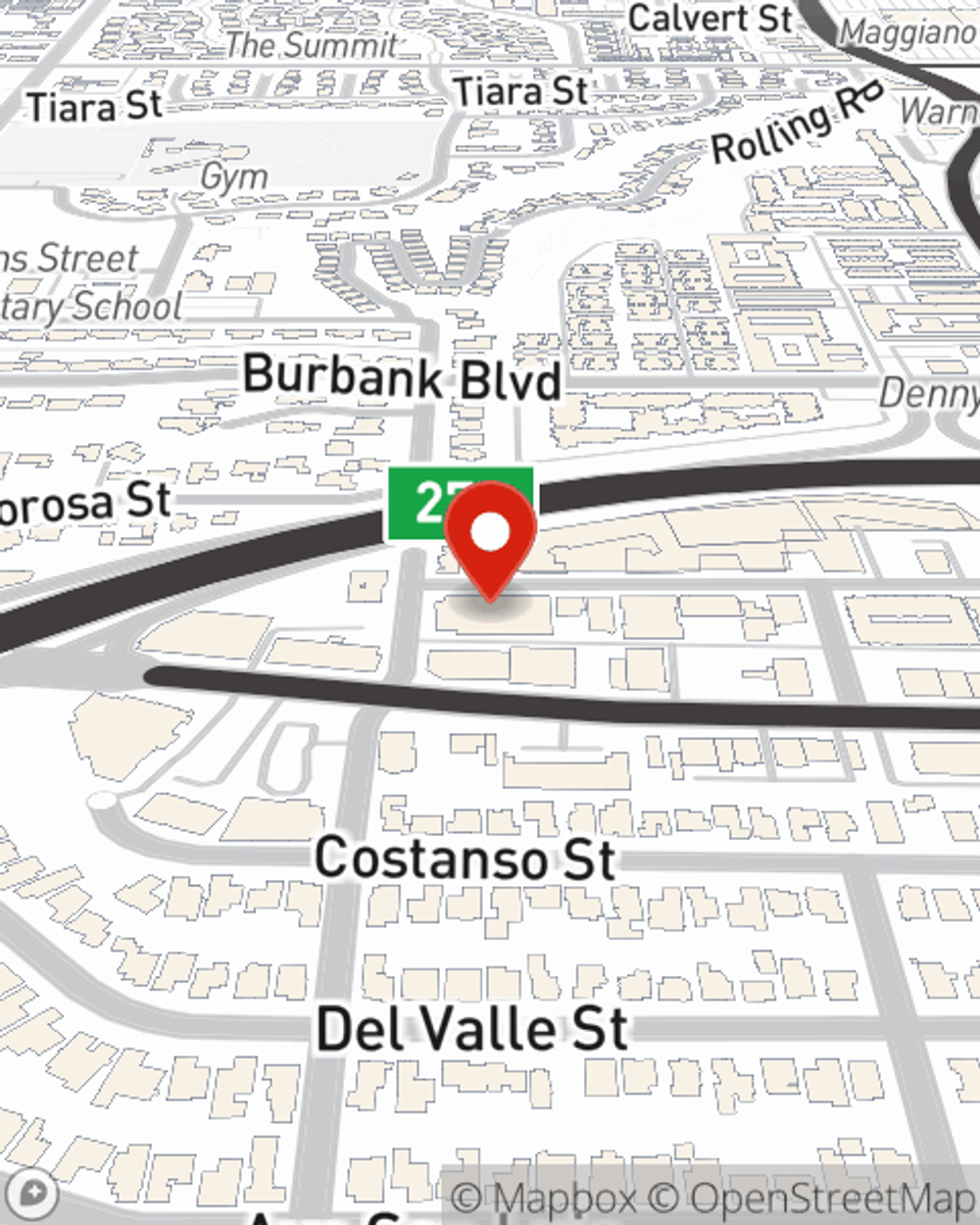

As a small business owner as well, agent Richard Lonie understands that there is a lot on your plate. Get in touch with Richard Lonie today to discover your options.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Richard Lonie

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.